Lower-Emissions Fabrics of the Future: How to create a market for low-emissions clothes and textile products

We share insights from stakeholders along the polyester value chain to help understand challenges and opportunities in creating a market for low-emissions chemicals

When we go shopping today it is easy to pick between two shirts based on price, style, quality, and color, but it is impossible to look at a product and understand its emissions, human health, or environmental impact. This is climate and environmental-differentiation — where consumers make purchasing decisions based on the greenhouse gas emissions, water consumption, and human health impact of the product.

Chemicals are found in nearly all the products we buy, from toys and clothing to household items like detergents and paints. The emissions generated during the production of these chemical and plastic products such as a shampoo bottle can be measured and tracked through Life Cycle Assessment, helping consumers understand the environmental impact of their purchases. Lower emissions-differentiated goods are a greener alternative and can warrant a higher market value. These higher profit margins can in turn help producers invest in the higher capex, lower-emissions production technologies and processes required. One emerging example of this is the polyester market, where consumer demand for differentiated products is growing. Retailers are taking advantage of this trend by improving their processes and reducing emissions while still maintaining positive returns.

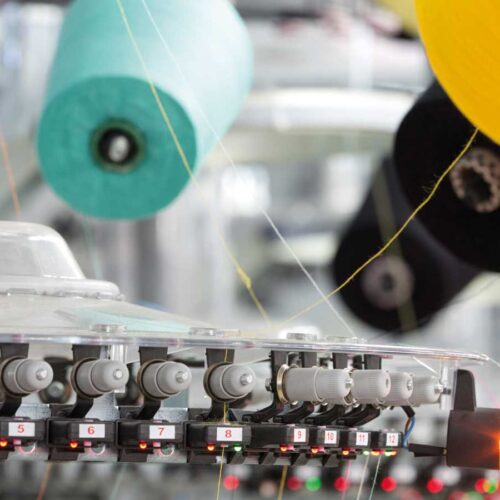

Polyester is one product in the chemical industry where emissions differentiated demand is growing. Fashion and furniture retailers are seeking alternatives to conventional fossil-based polyester such as recycled PET (polyethylene terephthalate) and recycled fabrics. Multiple startups are emerging for low emissions polyester such as Ambercycle, Tereform, Rubi Labs, and Circ, who are gaining traction by establishing pilots with major retail brands. Additionally, a consortium of chemical producers has agreed to establish a sustainable polyester fiber supply chain to utilize renewable energy and biomaterials to manufacture fibers for The North Face brand in Japan. These, in addition to the Science Based Targets (SBTi) guidance for apparel and footwear, Together for Sustainability Product Carbon Footprint Guideline, and the RMI Plastics Emissions Reporting Guidance, which help fashion companies set emissions reduction targets in line with Paris Agreement goals, are paving the way for the development of a market based on emissions for fabrics.

So, what is keeping a differentiated market for polyester from achieving scale? We spoke to innovators and key players across the polyester value chain to understand their challenges and the opportunities that could enable this market to thrive and function as a catalyst for emissions differentiation in the sector broadly.

High-end fashion retailers are currently leading the effort to develop a differentiated market through partnerships with startups offering lower emissions fibers, and developing science-backed sustainability roadmaps. However, stakeholders along the value chain from primary chemical production of paraxylene and ethylene, to fiber spinners and apparel producers all have a role to play.

The key challenges that need to be addressed in the polyester value chain, and extended to other chemical product value chains are:

- The cost of cleaner production – Emissions reduction solutions are expensive and costs can be challenging to absorb while maintaining margins in commodity markets. Consumers do not want to see an increase in prices, and producers do not want to see a decrease in margin. According to our stakeholder discussions, emerging niche markets willing to pay 20%-100% more for lower emissions polyester can overcome this, but large-scale adoption technologies need to be accelerated through policy support such as mandates establishing guaranteed offtake and supply side incentives like the Inflation Reduction Act.

- Willingness to Pay – Retailers have high ambition to reduce their footprint, but the consumer base with constantly shifting fashion trends makes decisions based on what is in style and not what is lower emissions. Additionally, despite fashion retailers showing willingness to pay, they are multiple steps in the supply chain away from the emissions-intensive steps making it challenging to send a demand signal and transact on lower emissions products. Developing a strong standard to allow products to clearly state their environmental impact can provide transparency and trust to inform consumer behavior.

- Low risk tolerance from financial institutions – Financial institutions enable the transition to take place by providing funding for companies to invest in emissions reduction solutions. Without a clear offtake for a higher-margin product, financing can be challenging to obtain. Mechanisms like buyers’ alliances or direct procurement contracts can provide certainty to financial institutions of the long-term viability of their investment.

- Competing attributes – The polyester consumer base is diverse and has varied purchasing criteria. Several attributes for chemicals exist and are prioritized differently. These include emissions, toxicity, water use, and circularity, each of which play a role in the future of fashion, but can confuse and muddy the waters for paving the way for a differentiated market. Aligning prioritization and accounting for these attributes is critical to moving forward with market creation.

- Policy and Reporting – Shifting pressures on carbon reduction for industry, as well as a lack of carbon accounting standards and corporate emissions reduction commitments causes headwinds in progress towards a lower emissions future. Regulation is emerging for polyester (EU Ecodesign for sustainable product regulation, digital product passport, NY fashion act, California EPR, etc.) but competition and intellectual property concerns make standard setting challenging to accept across the sector. Consistent reporting methodology is critical to set clear emissions baselines and allow consumers to trust the reported improvements being made by industry.

How does the polyester supply chain act as a pilot case study for the chemical industry?

Interviews from players along the polyester value chain show the challenges and opportunities that this market is facing in developing differentiated products. As we think about implications for the chemicals sector broadly, many of the considerations remain the same and can be leveraged to speed up the development of additional, low-emissions chemicals markets.

- Start with market segments that are already making commitments towards lower emission products. Markets such as high-end apparel, luxury vehicles, or building material providers are already asking for lower-emissions products. These consumers can show proof of concept for the differentiated markets where fewer alternatives exist. While demand reduction, substitution, and design efficiency are better solutions for some chemical products like single-use plastics, durable thermoplastics like car internals have fewer alternatives and need lower emissions alternatives.

- Build on emerging regulation. Regulations in the EU and California are paving the way for new standards for polyester and fabric manufacturing. These standards may seem hard to achieve initially, but when proven and then expanded by policy to additional geographies they can shift industry behaviors and make measurable impact. Producers can leverage emerging standards that have high ambition and work with like-minded companies along the supply chain to prove the value of the standards in application.

- Design a climate attribute and tracking system that enables market segments to connect with lower emissions supply, to allow companies to make credible sustainability claims on their emissions inventory (Eg. SiGreen and Digital Product Passports). Standard setting and harmonization create certainty in the emissions of the product being purchased and may also include other differentiating factors with clear benefits, such as toxicity or water use. Setting up assurance on sustainability criteria and certification gives stakeholders confidence that the product is aligned with their goals.

- Building a voluntary market for customers with a higher willingness to pay is a way to prove the process, lower costs and mitigate issues such as compatibility or quality along the value chain. The voluntary market can scale production volumes to bring down the production cost of new technologies to parity with traditional production. This reduces the green premium, enabling broader adoption throughout the market and helping buyers procure the products they need.

Why do we need to intervene? How does this expand into the chemicals sector more broadly?

Although there is early movement in differentiating the polyester value chain, progress remains slow and concentrated in niche markets. Additionally, the focus lies in increasing demand for recycled polyester products, which do not necessarily address emissions reduction impact. Voluntary commitment creates a market case for carbon-differentiated polyester, enabling companies along the value chain to align on shared emissions reduction objectives, gain access to capital funding, and respond to clear demand. Introducing regulation will provide greater incentives for technology investment and industry standardization, enabling greater emissions reduction on a prescribed timeline with government support. These interventions will ultimately drive down costs for production of low-carbon chemical products, enabling the market to expand into mainstream, volume-driven markets.

What comes next in our series?

Now that we understand the challenges and opportunities for developing a differentiated market for chemicals, we can start to analyze what types of interventions might work to accelerate the market for polyester specifically, and what frameworks can be used to extrapolate this to other products. In our next article, we will discuss the potential mechanisms that would work for the polyester value chain, where in the supply chain differentiation can be most effective, and what level of impact they may have on the emissions for polyester. We will share the framework for how this was designed, to show how it can be expanded for other products we use every day. We are stitching our way to a new chemicals marketplace, one fiber at a time.